GE Paid $314,511 for CEO’s Life Insurance Policies

General Electric Co. has helped Chief Executive Officer Jeffrey Immelt amass $22 million of life insurance coverage that one day could help his heirs cover the tax bill for his estate

.

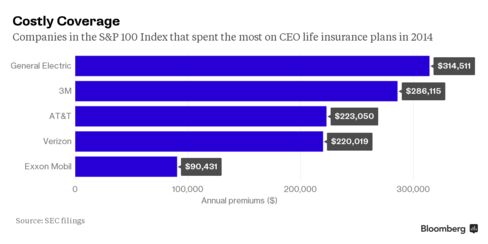

GE paid $314,511 last year for Immelt’s two life insurance plans, the most for a CEO in the Standard & Poor’s 100 Index, according to data compiled by Bloomberg. It’s one of a shrinking number of companies offering coverage designed exclusively for top managers.

On the lower end, JPMorgan Chase & Co. and Apple Inc. spent $101 and $2,520, respectively, on policies for CEOs Jamie Dimon and Tim Cook.

While many boards have scaled back executive perquisites after increased disclosure requirements and heightened scrutiny of pay practices, life insurance benefits -- a ubiquitous part of estate planning for high-earning Americans because of the tax advantages -- have received little attention.

Life insurance expenses are often lumped together with “an array of deferred compensation-related items, making it hard for investors to parse the details,” said Michael Pryce-Jones, director of corporate governance at CtW Investment Group, which advocates for pension funds that collectively manage $250 billion. “I don’t think it’s on the radar for shareholders in the way it should be.”

Universal Life

Executive insurance policies are reserved for a limited group of top leaders, a review of proxy filings shows. Last year, at least 10 companies in the S&P 100 Index offered their CEOs universal, or permanent, policies typically designed to last the insured’s lifetime. Some of the annual premiums go into investment accounts that can grow tax-free.

Immelt’s coverage includes two universal life insurance policies. One will pay two times his annual salary and bonus, which totaled $9.2 million last year, and the other provides a $3 million death benefit that’s grown 4 percent annually since he first enrolled, according to Fairfield, Connecticut-based GE’s most-recent proxy filing. GE, the world’s largest maker of jet engines and gas turbines, has spent more than $1.43 million on premiums for Immelt since he became CEO in 2001, according to data compiled by Bloomberg.

3M Co. paid $286,115 in premiums last year for CEO Inge Thulin’s executive life insurance, which has a death benefit of about $10.4 million, according to a proxy filing. Exxon Mobil Corp.’s Rex Tillerson and Honeywell International Inc.’s David Cote have accumulated benefits worth $11.5 million and $10 million in their executive life insurance plans, respectively

“We provide our named executives with additional benefits that we believe are reasonable, competitive and consistent with the company’s overall executive compensation program,” Dominic McMullan, a spokesman for GE, said in an e-mailed statement.

Spokesmen for 3M, Exxon and Honeywell declined to comment.

Dimon’s Plan

Of the 51 companies in the S&P 100 that disclosed expenses for CEO life insurance premiums last year, JPMorgan spent the least. Dimon’s plan, which provides a maximum coverage of $100,000, is available to all benefit-eligible employees, according to a filing.

“Our compensation philosophy is to have a transparent and fair compensation program for senior executives with no special insurance, health or medical benefits,” Joseph Evangelisti, a spokesman for the largest U.S. bank, wrote in an e-mail. “The board thought this was the most fair way to do it.”

Apple offers Cook the same insurance that’s available to all employees. Fred Sainz, an Apple spokesman, declined to comment beyond its proxy filing.

Companies must report perks given to any named executive officer if the annual aggregate value exceeds $10,000. Specific dollar amounts must be disclosed for all benefits that make up more than 10 percent of that sum or are worth more than $25,000.

Estate Taxes

While most Americans who buy policies do so to replace lost income after the death of a household breadwinner, the nation’s affluent often beef up their coverage to help heirs avoid fire-sales of assets to pay estate taxes.

The federal tax on estates worth more than $5.43 million is 40 percent. Including state levies, the government’s total share can approach 50 percent, an amount that can be difficult to pay for estates with significant assets tied up in illiquid holdings such as real estate, said Ivan Taback, a trusts and estates partner at law firm Skadden Arps Slate Meagher & Flom LLP.

“Oftentimes, they do not realize that their beneficiaries will have to come up with a massive check nine months after they die,” Taback said.

Death Benefits

Beneficiaries of company-owned plans can collect death benefits tax-free as long as the insured doesn’t have a controlling stake in the company. To avoid having the death benefit included in the taxable estate, many people assign ownership of their privately purchased plans to irrevocable trusts, according to Parker Beauchamp, CEO of Inguard, a Wabash, Indiana-based insurance firm.

“Creating the liquidity to pay estate taxes can literally save the beneficiaries millions” if it can help preserve income-generating assets, said Beauchamp, who specializes in plans for clients with complex needs such as billionaires and professional athletes.

The share of Fortune 500 companies offering supplemental policies to their CEOs fell to fewer than 25 percent in 2013, down from 52 percent in 2008, according to a study by Towers Watson & Co., a human resource consulting firm. Bolstered compensation-disclosure rules and the implementation of advisory say-on-pay votes at annual meetings have fueled a retrenchment of company-provided perks, said Keir Gumbs, a partner at law firm Covington & Burling LLP.

Exxon, Pepsi

Johnson & Johnson closed its executive life insurance program to new participants in January “in response to feedback and market data,” according to a March 11 filing. Exxon stopped giving the benefit to new executives in 2007. Firms including PepsiCo Inc. and Schlumberger Ltd. highlight in proxy filings that they don’t offer company-paid supplemental insurance policies to executives.

Spokesmen for the companies declined to comment.

Term policies, such as those provided to JPMorgan’s Dimon and Apple’s Cook, usually lapse when the covered employee leaves. GE’s Immelt and 3M’s Thulin are both covered by universal, or permanent, policies, which are more expensive.

While the premiums for term plans cover only the insurance, part of the annual cost for a permanent plan goes into an investment account. The balance grows and can be withdrawn free of taxes, making such policies attractive to some clients, Inguard’s Beauchamp said.

Investment Opportunities

Both General Motors Co. CEO Mary Barra and Caterpillar Inc.’s Douglas Oberhelman have company-paid variable life insurance policies, permanent plans that can give owners control over how the cash value is invested, proxy filings show. Spokesmen for GM and Caterpillar declined to comment beyond the filings.

Variable plans that offer investment opportunities in hedge funds or private-equity funds have grown in popularity among affluent clients in recent years, said Joshua Husbands, a partner at Holland & Knight LLP.

“These are the types of investments high-income folks would be making anyway -- and now they’re available on a tax-preferential basis through an insurance policy,” Husbands said. “Life insurance isn’t just about the death benefit anymore.”

No comments:

Post a Comment